tesla tax credit 2021 washington state

In order to meet the requirements for the credit the business must create new employment positions that increase total employment by 15 or more by March 31 2021. Section 179 Deduction Vehicle List 2021-2022.

Tesla Model 3 Tax Credit 2020 Off 78

Section 179 Deduction Vehicle List 2021-2022.

. Which Is More Reliable. Range Rover Tax Write Off. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car.

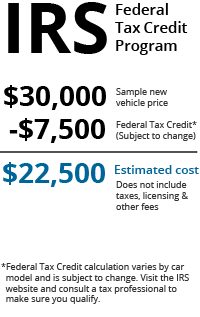

Customers who purchase qualified residential fueling equipment before December 31 2021 may receive a tax credit of up to 1000. Ford F150 Tax Write Off 2021-2022. Range Rover Tax Write Off.

Under Bonus Depreciation rules you can even purchase a Used Tesla Model 3 and use Bonus Depreciation. Tax Exemption Washington State EV Infrastructure Tax Exemption. There are Tesla stores in Seattle and Bellevue both with combined Washington state sales taxes of 95.

The 2021 RAV4 Prime plug-in hybrid still has the full 7500 tax credit. Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns. With this tax credit youd be getting a rebate on the sales tax you pay up to 2500 on new electric vehicles that cost less than.

1500 tax credit for lease of a new vehicle. The credit ranges from 2500 to 7500. With this tax credit a rebate sales tax pay 2500 electric vehicles cost Customers purchase qualified residential fueling equipment December 31 2021 receive a tax credit 1000.

In order to meet the requirements for the credit the business must create new employment positions that increase total employment by 15 or more by March 31 2021. Tesla and GM are set to. You can get a tax credit of 25 for any alternative fuel infrastructure project including building an electric charging station.

What Small Business Expenses are Tax. A few 2021 Mercedes Benz models like the X5 xDrive45e 330e and the 330e xDrive qualify for the credit. Tesla reached this mark in July of 2018 so the 50 credit phase out began in January 2019 and ran through the end of June 2019.

Under Bonus Depreciation rules you can even purchase a Used Tesla Model Y and use Bonus Depreciation. As of July 1 only cars costing less than 35000 qualify for the exemption. Porsche Cayenne Tax Write Off 2021-2022.

North Carolina offers a state emissions testing exemption and car pool lane access to electric and alternative fuel vehicles. This bill will extend the WA state EV sales tax exemption until June 2021 and eliminate the vehicle limit currently 7500 portion of current law. It exempts 25000 of the purchase price from sales tax so the amount might vary a little bit depending where you take delivery and what tax rate.

In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. Porsche Cayenne Tax Write Off 2021-2022. Which solar incentives end in 2021.

Jay Inslee Washington lawmakers propose electric vehicle rebates and other climate initiatives ahead of legislative session Dec. It also includes an emergency clause and will go into effect immediately ifwhen signed by the governor. 7500 Note that this credit which became available in 2009 will begin to phase out once auto manufacturers meet their sales quota.

For model year 2021 the credit for some vehicles are as follows. Discover more about state utility and local energy incentives here. 4502 Chrysler Pacifica Nissan Leaf others.

Powerwall is designed to qualify for the Federal Investment Tax Credit ITC when it is installed on an existing or new solar system and is charged 100 with solar energy. Effective July 1 2016 buyers or lessees of new electrically powered vehicles pay NO SALES TAX in Washington State on the first 32000 of the selling price or total lease payments made for vehicles that meet these requirements. Oregon offer a rebate of 2500 for purchase or lease of new or used Tesla cars.

The 2019 and 2021 Audi e-Tron also qualifies. The sales tax credit applies to any EV with a selling price under 45k and that includes Teslas destination fee. What Small Business Expenses are Tax.

Tesla Model X Tax Write Off 2021-2022. 2500 tax credit for purchase of a new vehicle. When you purchase lease or convert an Electric Vehicle in Washington State.

Tesla Model 3 vs. Plug-in car owners have to pay up to 150 more to renew their registration than previous owners as the state charges a three-tenths of a percent fee for vehicle use taxes. 11th 2021 622 am PT.

In the House version an 8000 tax credit excluding the Model 3 Performance S and X but in the Senate version a 10000 tax credit excluding the Model 3 Performance S and X on 2022 tax. Heres a comprehensive guide to help you figure out if your electric vehicle still qualifies for any federal tax credit and state incentives. Tesla and GM have met.

Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it. This bill has bi-partisan sponsorship and is supported by the governor. Tesla tax credit 2021 washington state.

The 2021 Volkswagen ID4 First Pro and Pro S versions qualify. Alternative Fuel Vehicles Plug-In Hybrids Washington State Tax Exemptions. In Washington new vehicles are subjected to a sales tax of 68.

2000 BO tax credit for each qualified position created. Tesla Model X Tax Write Off 2021-2022. NO SALES TAX In 2016 House Bill 2778-S was signed into law.

Select utilities may offer a solar incentive filed on behalf of the customer. Tax Exemption Washington State. Ford F150 Tax Write Off 2021-2022.

Tesla and General Motors are the only manufacturers that have reached the 200000-car milestone meaning new purchases of qualifying vehicles from these manufacturers are not eligible for the electronic car tax credit. Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform. The State of Washington sales tax exemption no longer applies to Tesla.

Tesla cars bought after December 31 2021 would be eligible for.

Tesla Model 3 Tax Credit 2020 Off 78

Tesla Model 3 Tax Credit 2020 Off 78

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

Elon Musk Can Afford Biden S Ev Snub Reuters

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557 4215

Tesla Model 3 Tax Credit 2020 Off 78

Elon Musk S And Tesla S Cozy Government Relationships Gets Tested By Biden Administration The Washington Post

Electric Vehicle Tax Credits Rebates Snohomish County Pud

Latest On Tesla Ev Tax Credit March 2022

7 500 Electric Vehicle Rebates Fail In State Legislature As Climate Proposals See Mixed Results The Daily Chronicle

Electric Vehicle Buying Guide Kelley Blue Book

Behind Washington State S Ev Tax Creating An Electric Vehicle Infrastructure

Latest On Tesla Ev Tax Credit March 2022

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

2022 Washington State Ev Trends Electric Car Research

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek